As such, it extends the prior burgeoning debate on the hedging ability of cryptocurrencies in normal period ( Wu and Pandey, 2014, Briere et al., 2015, Eisl et al., 2015, Bouri et al., 2017, Corbet et al., 2020, Klein et al., 2018, Shahzad et al., 2019) to the post-pandemic period ( Goodell and Goutte, 2021, Nguyen, 2021, Raheem, 2021). Therefore, it raises the first legitimate academic question that quantitively, to what extent does the pandemic-induced uncertainty affect price discrepancies in cryptocurrency markets? As a step further, another research question is that whether any hedging asset exists during the crashes. Unlike in traditional stock and hedging assets markets, where investors experienced large losses and became less active during the pandemic periods ( Zhang et al., 2020, Ding et al., 2022), cryptocurrency markets retained their energy. 1Īlthough in less severity, we have also observed a plunge in the gold market, which has long been considered a safe haven ( Mariana et al., 2021). Almost immediately after the declaration of the WHO, global financial markets experienced one of their most dramatic crashes in history.

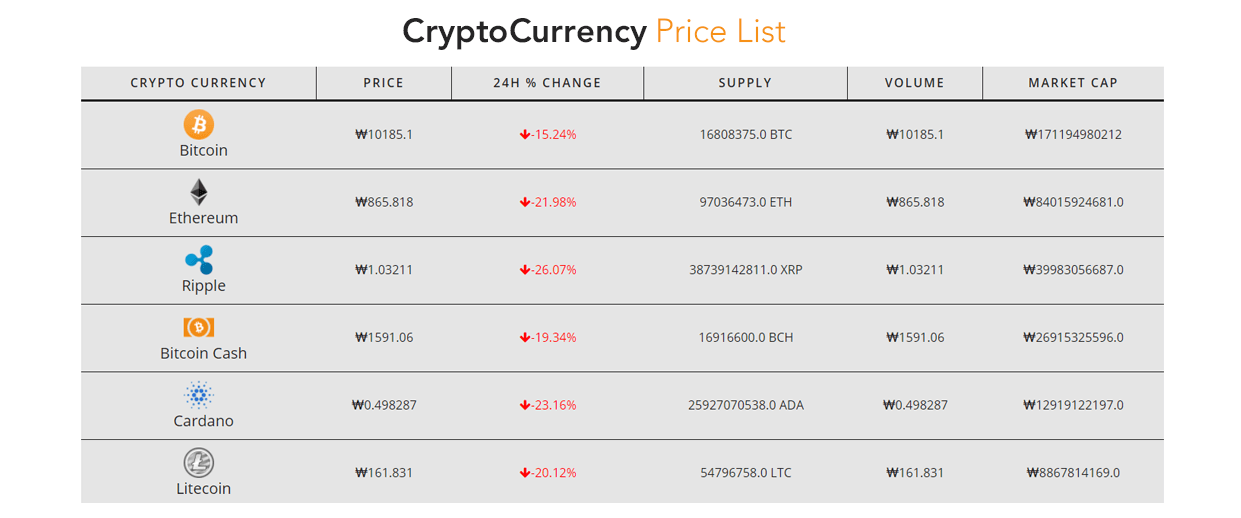

As suggested, there are conservatively 50 million active investors involved in cryptocurrency-related transactions on more than 100 exchanges worldwide ( Makarov and Schoar, 2020).įirst discovered in the Chinese city of Wuhan in December 2019, and then declared as pandemic status by the World Health Organization (WHO) in March 2020, COVID-19 has induced (and probably will continue to cause) enormous costs in lives and economies worldwide ( Goodell and Goutte, 2021, Mazur et al., 2021). Despite the fluctuation, cryptocurrencies of various types remain attractive in the global financial market.

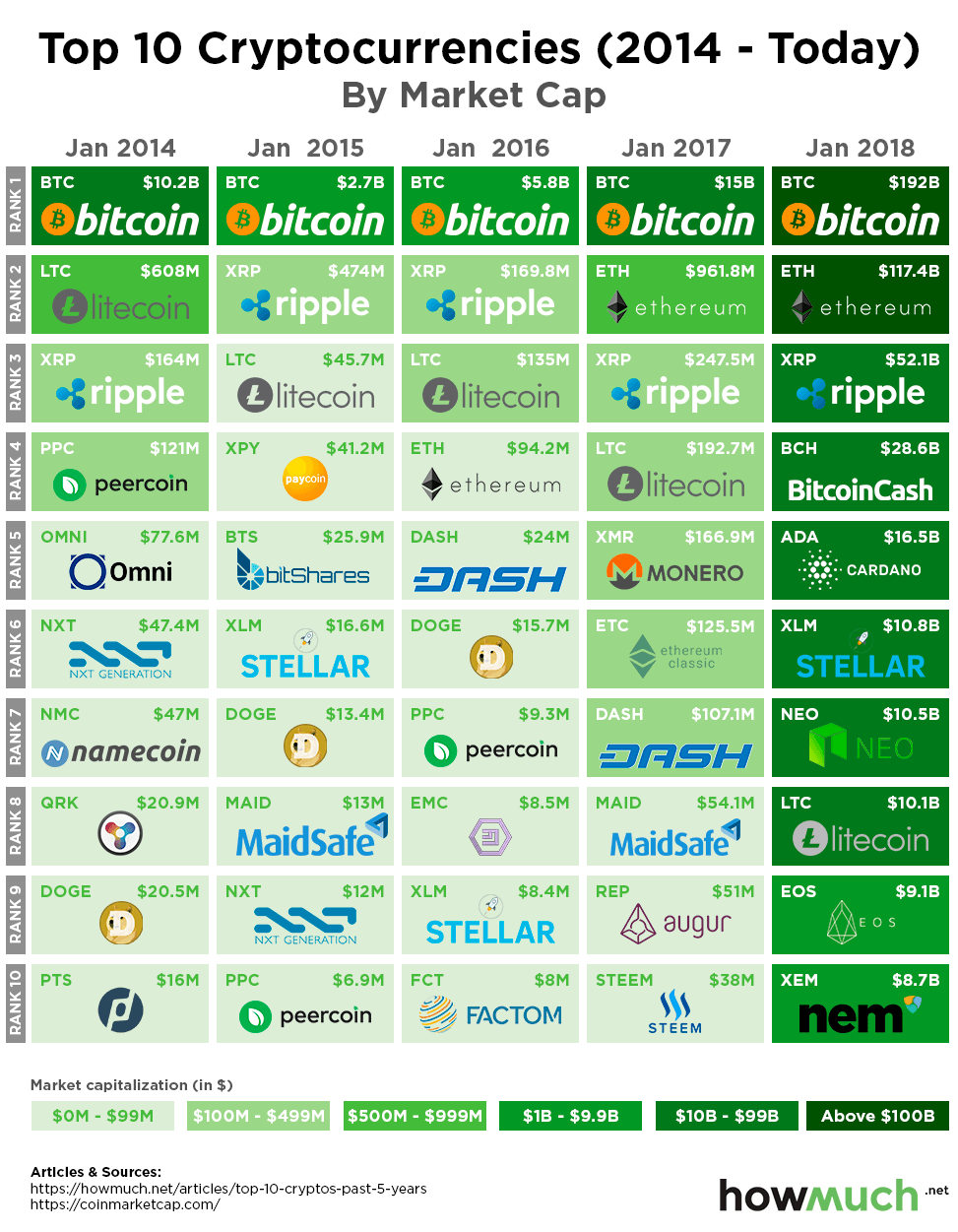

The past decades have witnessed their fervent surging and subsequent sagging in terms of price and trading amount, as well as recent vibration during the COVID-19 pandemic. It was the best of times, it was the worst of times, regarding cryptocurrencies. We also find that domestic capital control, sanitary policy stringency, uncertainty aversion, individualistic culture, and governmental power could moderate the general effect. We then verify our “alternative investment” hypothesis on the mechanism by showing that countries with intensified exposure to media hype on COVID-19 topics and with more panic emotion among citizens during the pandemic generally experienced larger Bitcoin price discrepancies than their counterparts. We find that price discrepancies are larger in countries with confirmed cases of COVID-19 and rigorously implementing lockdown policies. Using the emerging of the COVID-19 pandemic in 2020 and the subsequent lockdown policies implemented by a group of countries as natural experiments, we adopt a difference-in-difference framework to examine how the nexus affects Bitcoin price discrepancies. In addition to prior explanations that generally attribute this phenomenon to domestic capital controls during normal periods, we provide another explanation that investors perceive cryptocurrency as an alternative (hedging) investment, especially under uncertainty. The past decades have witnessed recurrent price discrepancies in cryptocurrency markets across countries.

0 kommentar(er)

0 kommentar(er)